BETSY WESTCOTT | Australians Living With Financial Stress

BETSY WESTCOTT | Australians Living With Financial Stress

Financial stress and hardship are increasingly common, but there are ways to take control. Betsy Westcott joins Shares for Beginners to discuss how younger Australians carry the biggest burden. By getting proactive instead of ignoring problems, you can understand expenses, increase income, and tap helpful resources.

Betsy provides advice for becoming proactive through understanding expenses, increasing income, and utilizing resources like financial counselors. She emphasizes open communication and leading by financial example. With insight from experts, this episode helps equip listeners to tackle financial challenges.

"You're there worrying about whether you can send your kid on the excursion or how you're going to pay the bill, or just the simple fact that your expectation of what life should look like at this age isn't matching up with your reality. And it's so oppressive. And like I said, it impacts the quality of your sleep. For example, you wake up in the morning at three am your brain starts ticking, spiralling. You get into that terrible cycle where you can't let go of the negative thoughts that makes you tired. That means you're skipping the gym and you're not looking after your physical well being or your mental well being at work. You're distracted because this is kind of this cloud that's over you that affects your performance. You're reaching for the sugary snacks at 03:00 p.m. To try and get yourself through. And by the time you navigate traffic and get home, you're irritable, you're snapping at your partner, the kids are driving you mental, and everything's kind of on edge. And it's oppressive, but it is something that is solvable if you lean into it, if you take action. It's the keeping our head in the sand. It's the closing our eyes and hoping it'll just go away and resolve itself. It's the not dealing with fact and going,"

(01:01) Phil Muscatello talks to Betsy Westcott about financial stress

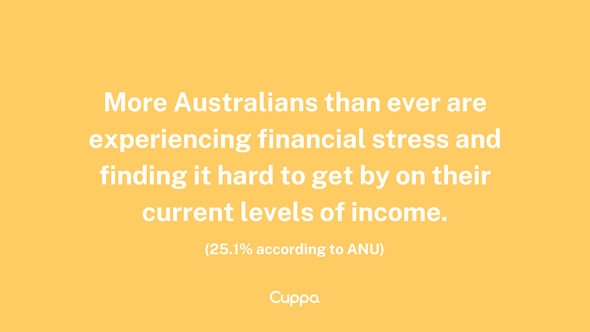

(02:37) One in four Australians experiencing mortgage stress according to research

(09:27) There's a number of things you can be doing to improve your financial situation

(11:49) According to Finder, Australians spend about one $1200 on unused subscriptions every year

(15:06) The three most common emotions associated with money are fear, shame and guilt

(21:33) Sometimes we put too much worth on the value of a present over the sentimental value

(23:53) It's important to communicate money and financial responsibility with your kids

(28:02) Betsy and David Koch have put together a course on dealing with financial stress

(32:19) For listeners of this podcast, we have a special deal, 10% discount on Dealing with Financial Stress (cuppa.tv) using the promo code PODOFFER

TRANSCRIPT FOLLOWS AFTER THIS BRIEF MESSAGE

Get 4 months free on an annual premium plan when you use Sharesight, the award-winning portfolio tracker. Sign up for a free trial today.

Sharesight automatically tracks price, performance and dividends from 240,000+ global stocks, crypto, ETFs and funds. Add cash accounts and property to get the full picture of your portfolio – all in one place.

Portfolio tracker Sharesight tracks your trades, shows your true performance, and saves you time and money at tax time. Get 4 months free at this link

EPISODE TRANSCRIPT

Australians Under Financial Stress

Chloe: Shares for beginners Phil Muscatello and Finpods are authorised reps of Money Sherpa. The information in this podcast is general in nature and doesn't take into account your personal situation.

Betsy: Their love for their children was actually one of the drivers behind why they were in so much financial stress, because they really wanted to provide their kids with the best of everything and not to have to really understand how money worked and not to be burdened with jobs and stuff and the love that was found. But actually, they weren't setting their kids up for success in the real world. They didn't understand the value of work, they didn't understand how to pay bills, they didn't understand how loans worked. And talking to any young adult, those lessons are some of the biggest shocks when you move out of home. And I think you ask anyone, and having those skills early and understanding how to use money to really support yourself in creating a life that was sustainable and that you really enjoyed, that's a wonderful skill. That's something so valuable to pass on to your kids.

Phil Muscatello talks to Betsy Westcott about financial stress

Phil: G'day and welcome back to shares for beginners. I'm Phil Muscatello. Today we're going a little bit off topic to cover something that's currently affecting many Australians and that's financial stress. The country's been through an extended period of low inflation and low interest rates, but this year has been a rude awakening. Rents are through the roof, credit cards are groaning under the weight of grocery and energy bills, while mortgage holders are seeing their repayments jackpotting nearly every month. G'day, Betsy. What an introduction.

Betsy: I know. Happy thoughts, happy thoughts.

Phil: But we were just having a happy thought that this is the third time you've been on the podcast. So welcome back.

Betsy: Thank you. It's always a pleasure to be on shares for beginners.

Phil: Um, it's always a pleasure to have you and congratulations on all of the work and kids and life, and everything seems to be going tickety boo at the moment.

Betsy: Yeah, it's not too bad. Um, look, I Am experiencing all those things that you mentioned in terms of mortgages, repayments, jackpotting. But life is really good. We've got a growing family, growing businesses, and we live in Australia.

Phil: That's right.

Betsy: Really ask for much more than that.

Phil: But what about grocery bills?

Betsy: Crikey. I had a baby boy first time around. Uh, and suddenly we're the three litre milk family. I didn't think that would happen until he was a teenager. I'm actually a bit scared about when he becomes a teenager. He has quite the appetite.

Phil: Boys are like that. I remember that was what I was like. Now, let me introduce you correctly. Betsy Westcott is a financial wellness coach and founder of the Inner Money Journey, a financial coaching platform that helps individuals and couples to live a financially free and secure life.

One in four Australians experiencing mortgage stress according to research

So let's talk about financial stress. How is it affecting, or what's your research showing and how it's affecting ordinary Australians?

Betsy: M. It's a very ever present and ever growing issue. We had that really unusual, uh, period where we had the global pandemic. We were all locked down, and that created a lot of financial upheaval then, but coming out of that, all of that pent up demand and people had saved money, and we just saw inflation spike because of more demand, but also a lot of supply chain issues. And to compensate with that, our, uh, Reserve bank, the Reserve bank of Australia, has initiated the shortest, sharpest rise in interest rates in over 30 years. And that has worked in some degrees of quelling inflation. But as we were discussing before the show, it's not affecting people evenly. We've also got a whole generation of individuals working Australians who've actually never navigated this before as well. So it's a new set of skills that they need to develop and a new reality that they need to adjust to. Because if you're, uh, an average mortgage holder with, say, maybe a $600,000 mortgage, 4.25% in interest rate rises, that's significant. And that's not money that you can make up in a single year by just neGotiating, uh, a pay rise. Maybe the exceptional individual might be able to do that, but that means that your dollar is going less distance and you've really got to make some changes, either around your income or your spending, in order to compensate with that. And as a result, we've got about one in four Australians beginning to experience mortgage stress. I would say those figures might have jumped a bit after the most recent interest rate rise. And mortgage stress is defined as your home loan or housing repayment because this applies to renters who have also had a really challenging time that equating to more than 30% of your income. And the latest data I was reading just this morning was saying that a couple who had taken out a mortgage just two years ago on the average income, buying a median property here in Sydney, their repayments would be making up 66% of their income right now. And that's a big chunk of your pay packet. It's not sustainable, that's for sure. And then as a result of that, a lot more people are cutting back in different areas. They're experiencing more food insecurity because it's not just housing that's got expensive daycare, fuel, electricity, groceries, entertainment, you name it. Health care is another big one. So it's a really challenging time for people. And the thing about financial distress, it's not just about the money, is it? It's insidious. It affects all areas of your life. Your mental well being, physical well being, your relationships, your work performance, your sleep. Your sleep, that precious commodity. So it's no small thing, is what I would say about it.

Phil: Yeah. So what demographics are being affected at the moment.

Betsy: So research indicates those being most affected are your younger Australians, those who are either renting and are, uh, sort of establishing themselves in their careers. They might have significant education, debt, hecs debt, those with young families and recently acquired mortgages. Because, of course, with the spike in home prices, that means you've spent a lot of money getting that foothold on the property market. And you also have a high level of debt. So the capacity to absorb those interest rate rises and the significance of those interest rate rises are more profound in that demographic. And it's often coinciding with a period of life, something I'm personally navigating, where you're bringing little people into the world and that compromises your ability to earn income. And so that's creating a lot of stress. And Alan Kohler, one of my favourite financial experts, he always looks like he's having such a good time when he does his ABC segments, which I always enjoy, but he did a segment analysing the combank results, you know, just pointed out in their data that a lot of the contraction in consumer spending is coming from younger generations. They're dwindling down their savings, whereas our older generations are actually upping their spending and also increasing their savings. And then, of course, we've seen.

Phil: And they're getting so much more money with higher interest rates as well benefits if you've paid off your home.

Betsy: Yeah, good times.

Phil: Some boomers.

Betsy: Some boomers, exactly. We've got to be clear about that. And then also we've seen a lot of corporations have some pretty extraordinary profits this reporting season. So you've sort of got to question, are our corporations sort of taking advantage of this inflationary narrative to actually bank some really good profits? So, yeah, it's not hitting evenly across.

Phil: Australia, but also not forgetting renters as well.

Betsy: Absolutely not forgetting renters.

Phil: Insane. What's really strange is this seems to be common across all of the Anglophone world.

Betsy: Yeah, it does.

Phil: Uh, that's happening in Canada. We've got exactly the same situation, America, the UK and so forth. There just doesn't seem to be enough rental properties and I don't know what's going on behind.

Betsy: Yeah, yeah. Because like in Australia, we've got very high migration, we haven't had a lot of property development, plus the extreme spike in house prices, forcing more people to remain rented.

Phil: Maybe the Airbnb effect, perhaps, as know people are preferring to do the short term rentals rather than long term.

Betsy: Yeah. To make more gain. Absolutely. And you have seen sort of governments, um, I know Western Australia introduced some new legislation to limit how long properties can be put up as an Airbnb M accommodation to try and combat that, because it takes a while to build a house. So it's not going to be a quick fix. Even though we've got lots of very bright people coming up with all these different solutions around housing, you're looking at years, decades, even before that can really.

Phil: We don't even have the labour force for it either.

Betsy: True. Yes, very true. And then a lot of, um, those that have the skills to build houses are being pulled into big infrastructure projects which pay better and you don't have to deal with the customers quite so much. So, yeah, it's all coming together as this very perfect storm. We're living in some pretty extraordinary times. And what I always find helpful in situations like this is to really distil it down to what is within my control and what's outside of my control, and really focusing your energy on that which you have control over, because you can rage about interest rates and government spending. We do get an opportunity to influence that with our democratic voting power, but that's as far as it, you know, really focusing on at a micro level, what can I be doing and how can I improve my situation?

Phil: Is Aldi the only answer?

Betsy: I wouldn't knock Aldi. They have some great meat in there. Quite the fan.

There's a number of things you can be doing to improve your financial situation

There's a number of things you can be doing. The first and the most overarching theme is that you need to be a person of action, your own action hero, if you will. If that helps do that, put on a persona of the action hero, but be really pragmatic and lean into the numbers and know your numbers. What's actually going on here? And that's something that, as a financial coach, I have to tell you time and time again, most of my customers just don't know what they're spending I.

Phil: Was having and they're in paralysis mode as well.

Betsy: Yeah, because.

Phil: Sorry, I interrupted your thought.

Betsy: That's okay. No, but you make such a good point because it can be really overwhelming. Money is not just about math and logic. It carries such a huge emotional charge around our sense of competency, our, uh, sense of self worth, what others think about us. And so when we're under stress and strain, it can really paralyse us. And we also, as a nation, don't have the best financial literacy and so we don't actually know what we can do to resolve these issues and thus we do nothing, which is the worst thing. So really try and be a person of action. Figure out, okay, what's actually going on here. And it's much better to deal with facts than feelings or intuition or fallacies. That's the word I'm looking for. Thank you. And so, yeah, know your numbers and then identify. Okay, well, what are my opportunities here? Is it spending less? Is it earning more? Which of the levers available to me do I want to pull? So on the spending less side, look at the things that are costing you the most money and do you have an opportunity to reprioritize or renegotiate? So if it's high interest debt, you really want to be creating a plan to be making additional repayments and getting rid of that as quickly as you can because it's so expensive. If it's a mortgage or even your lease, is there opportunities to negotiate a better deal? I know for the renters that might be quite challenging in this environment, but if you don't ask, you'll never know. But certainly with your mortgage, make the most of all the information that's at hand. Find out what other institutions are offering on like, for like, payments and see if you can use that to negotiate a better deal. Because a 1% interest saving on a million dollars mortgage, that's ten grand back in your pocket, which I don't know per year. And look, ten grand. I'll take it. Happy days.

According to Finder, Australians spend about one $1200 on unused subscriptions every year

Then it's looking at your bills. According to Finder, we all spend about one $1200 on unused, unnegotiated subscriptions every year. Again, that goes a long way. So just going, have I actually used this subscription? And I did. Mine recently discovered I have a Stan account. Who knew? Not me. So that was a little, uh, incentive to really cancel that one, actually, because I wasn't using it clearly. Or am I actually utilising this and, um, getting bang for my buck? Is there a better deal out there? Insurance policies is a great one, particularly as car health and home insurance have spiked quite significantly this year. So you would absolutely be a fool to just be renewing and rolling over, um, make sure you're negotiating a better deal each time.

Phil: And it's so easy to go to isolect or compare the market or whatever. I mean, I just did that recently with our car insurance. I mean, got $300 off it and stayed with the same insurer because they perfect, they always have retention, people that you talk to and the same with the broadband. Yeah, sorry, go on.

Betsy: Yeah, well, no, that to your point though, you have a lot more power than you realise. And these large companies, they don't want to spend money acquiring a new customer when they can just keep you. So they are incentivized to retain you as a customer. So you've got a better chance than you realise at getting some more money back in your pocket. And yeah, $300, it's not going to set the world on fire, but it all adds up. And if you do this consistently across all your bills, then you're really going to make some significant savings. But the thing that I like to point out is that there's only so far we can go. On the spending side, there's a limit, isn't there? Whereas on the income side, that's limitless. It's really up to you what you do there. And that's the one that I think we often overlook. We just default to the spending. But with the digital economy and side hustles and being able to pick up extra shifts or even just being able to flip things like look around your house and other items that you haven't been using lately that you can Sell, there's a lot of ways to make money, there's online surveys, so many different things. If you're willing to do it and put the time and effort in. And I would rather make more money than cut back on my spending, I'll be honest. So, um, making sure you're looking at both sides, the ledge is super important.

Chloe: Super is one of the most important investments you'll ever make. But how do you know if you're in the best fund for your situation? Head to Lifeshirper.com au to find out more. Lifesherpa, uh, Australia's most affordable online financial advice.

Phil: Yeah, one of my favourite podcasts, where I get a lot of inspiration from is side Hustle Nation. It's an American podcast and it's quite astonishing the kind of money that you can make with a side hustle. I believe there's a lot of administrative work that can be done online. And people who can stay at home and pick up extra work by doing this, isn't there.

Betsy: Yeah, well, I was just doing a lap around Centennial park the other day. Ran into a, uh, girlfriend, and she had this gorgeous golden retriever with her. And I was like, did you buy a dog? She's like, no, I just put myself up as a dog minder, uh, on Mad paws, and I get, like, $65 a day to hang out with dogs, which I love doing. I was like, yeah, good on testing. That works.

The three most common emotions associated with money are fear, shame and guilt

Phil: So let's go back just to, uh, because you mentioned about becoming your own action hero, and we talked about paralysis. What's it like? That kind of. I'm just pointing this out because I'm going through a bit of financial stress at the moment as well. And hearing what you were talking about, we'll come to you and Koshi and Cookie and all of the blokes, they should be cook O and Kosho.

Betsy: I know what's happened here in Australia.

Phil: What's going on with Australia? But the emotional side of things about what you're feeling, and it's just actually quite. I mean, it's not fantastic, but it's nice to know that you're not the only one going through this.

Betsy: Yeah, absolutely not. And we all experience financial stress from time to time. How acute it is for us as an individual depends on our own sort of money persona and the meaning and the value that we hold to be true about money and self worth and all of those things. And then also the shame. And shame. Yeah. The three most common emotions with money is fear, shame, and guilt. Isn't that like, you think it'd be like, joy, but no, fear, shame, and guilt. Because I think this thing that we all need to use to create security and safety and prosperity in our lives, for a lot of us, we don't have great financial, uh, knowledge. We have a certain level of skills, but it's just not something that we're taught about in a coherent, consistent manner.

Phil: Except some very lucky people that you come across. Those parents really took them in hand.

Betsy: And I know, I think about this a lot. As a new parent, I'm like, okay, what kind of money skills do I really want to pass on to my child in utero?

Phil: Money skills.

Betsy: Yeah. Are you listening down there? Yeah. And then there's how severe is the situation? And do we feel like we've got good connections around us to support us through it? Because money brings up, for example, a lot of shame, and we feel like it's just happening to us. We're the only one in the world. And particularly in the era of things like social media, where you look online and there's a highlight reel and everyone seems to be living the life of Larry, and you're there worrying about whether you can send your kid on the excursion or how you're going to pay the bill, or just the simple fact that your expectation of what life should look like at this age isn't matching up with your reality. And it's so oppressive. And like I said, it impacts the quality of your sleep. For example, you wake up in the morning at three a um m your brain starts ticking, spiralling. You get into that terrible cycle where you can't let go of the negative thoughts that makes you tired. That means you're skipping the gym and you're not looking after your physical well being or your mental well being at work. You're distracted because this is kind of this cloud that's over you that affects your performance. You're reaching for the sugary snacks at 03:00 p.m. To try and get yourself through. And by the time you navigate traffic and get home, you're irritable, you're snapping at your partner, the kids are driving you mental, and everything's kind of on edge. And it's oppressive, but it is something that is solvable if you lean into it, if you take action. It's the keeping our head in the sand. It's the closing our eyes and hoping it'll just go away and resolve itself. It's the not dealing with fact and going, uh oh, this can't be happening to me. Well, it is. And, uh, I love the old, what was the prime minister in the UK in World War II?

Phil: Churchill.

Betsy: Churchill. Saying, if you're going through hell, keep going, keep stepping forward. And so you really need to do something about it. But you don't have to go it alone. There is a plethora of resources out there to support you. I mean, first and foremost, the national debt helpline. It's a free private financial counselling service with professionals to help you kind of gather that information, develop an action plan. They'll even negotiate with your creditors and your bill providers on your half.

Phil: Really?

Betsy: Yeah. They're so helpful.

Phil: What's that number?

Betsy: Yeah, well, it's a great number, actually. It's 1800007007 I always think, like, oh, James Bond. That's what I'm raising your debt. Yeah, he's like on the line and he's working a deal. I love that idea. There's also one for First Nation, as Australians called mobstrong. I don't recall the phone number for that one, but there are two things worth noting. I mean, uh, don't be afraid to tell your utility provider or your financial services institution. Hey, I think I'm going to have a bit of trouble with this bill. I really want to pay it. I'm committed to paying it, but I'm going to need some support. Can we work out a deal? They don't want you to go into default. They don't want you to experience hardship. They'll really work with you to come up a plan. In fact, they're obliged to work with you to come up with a plan. So be on the front foot there.

Phil: They are obliged. What? There's a legal requirement for utility providers.

Betsy: Yeah. And banks all have hardships teams and they're all professionally trained, acutely aware of what's going on. And the more you work with them, the more collaborative that they are. It's when you ignore the phone calls, it's when you just pretend like it's not happening that the problems kind of mount for you. So being on the front foot there and then reaching out and telling people around you that you're going through this, I mean, often we might have these expectations of ourselves and that, uh, we can't tell our partner what's going on because we'll let them down. But a problem shared is a problem halved. Um, it's something that you can tackle together, and two heads are better than one, as the saying goes. And if that's not something that you have available to you, is there a trusted friend in your broader circle around you? Because whilst it feels like you're the only person it's happening to, let me tell you, you're not. And other people will have gone through it before. And it's really just about developing the mindset and the skills and the strategy to get you through that, that's going to solve this thing. And it is solvable. Everything's figureoutable, as Murray Folio says, um, which I really love as well. So they're there and then there's of course, things like lifeline, Selvos, Vinnie's who provide different services, whether it's counselling for your emotional well being, whether it's food, bank services, whether, know, alternative accommodation, clothing, things like that. There's so much out there. We do live in the lucky country, but you got to put your hand up and set that ego aside.

Sometimes we put too much worth on the value of a present over the sentimental value

Phil: And it's also interesting about having that conversation with the family, because when it comes to Christmas or birthdays, apart from anything else, it's a nightmare trying to think of presents for people in the lucky country that have everything already anyway. Uh, who needs that stress apart from the financial stress as well.

Betsy: Yeah. And I think quite often we put too much worth on the value, like the monetary value of a present over the sentimental value of a present. Someone taking the time to really think about finding something for you that you'll really enjoy, that really acknowledges who you are as a person or the time and care to make something for you. Those are the most beautiful gifts, I think. But often we're just so busy and it's Christmas and we've got to buy and we're kind of outsourcing our, uh, personality to material goods by buying flashy things so that people think we're flashy and really successful. It's just a commercial trap. If you can create a little bit of space to, uh, really put some time and thought into things, you don't need to be spending a lot of money. And same goes for activities. Our number one favourite date is fish and chips with a bottle of wine on the beach. Our sun runs around, we sit on a chair, seagulls pester us. But it's just a really lovely time. We can people watch, we could go to Mimi's and spend, I don't know, close to a grand probably. And it's a lovely time. But when you're doing these activities, what's the purpose of it? Connection. Time spent together, making memories. Money is not an essential part of that, uh, equation to make a special memory. And I think it's just remembering that sometimes m keep mhm it simple.

Phil: We'll get back to the show right after this brief message.

Why am I buying, holding or selling a share? If you can't answer that basic question

Why am I buying, holding or selling a share? If you can't answer that basic question, then you don't have a plan. The best investors are ruthless in executing their plans. I've been fortunate to meet many great investors on the podcast. Tony Kynaston is one of the best. He has a clear and systematic approach to investing that is honest, sensible and methodical. It's called QAV quality at value. Uh, Qav now offer an excellent light plan for only $29 per month. You can follow their buy and sell recommendations and learn the ropes. And the first month is free using the promo code SFB LIGHT Go to Qavpodcast.com au to sign up.

It's important to communicate money and financial responsibility with your kids

That's Qavpodcast.com au using the promo code SFB LIGHT Past performance is not a guarantee of future returns. Please read the QAVFSG and consult a financial professional before investing. I receive a small commission for services I recommend. And I only recommend services I use myself. And, um, what about having conversations with the family? Because kids become involved with this as well, because they're going to respond to the stress. How should that be dealt with?

Betsy: Yeah. And kids are. They're like. They got these like little antennas up, aren't they? They're very good at reading situations. And again, it's really important to be mindful of the language, the energy, the conversations that you're exposing the kids to. So I think as parents, it's finding that balance between communicating money and financial responsibility with your kids, but not putting the responsibility on your kids, particularly if they are younger, they're just kids. Allow them to be. So in the good old days, you.

Phil: Could send them out to work. Three, four.

Betsy: Come on, you're trying to chip in. But to explain to them how money works, what things cost, what mummy and daddy do for a living, how do they decide what to spend money on? Potentially empowering them to make choices around. Okay, here's how much we're going to be spending on a Christmas present. We can do this or that. Which one do you choose? And just really creating that awareness for them and even just for yourself, being mindful around the language that you use from. We can't afford that, or that's not something we choose to prioritise right now. Just that language can really change it from a. We're less than, we're restricting, we're going without to. We're making an informed and empowered choice about something.

Phil: That's really interesting to say that to a kid because it's kind of elevating him to talking to them like an adult.

Betsy: Yeah. And again, make sure it's age appropriate. Not sure my son at two is really going to comprehend much, but if your kids are sort of hitting ten, 1112 teenagers, things like that, I do think it's important to role model good, healthy, practical money behaviours. Sometimes we can love our kids a little bit too much and in a way that actually harms and disables them. Absolutely, yeah. I was recently working with a couple who they themselves were experiencing a lot of financial challenges and their love for their children was actually one of the drivers behind why they were in so much financial stress. Because they really wanted to provide their kids with the best of everything and not to have to really understand how money worked and not to be burdened with jobs and stuff and the love, that was sound. But actually they weren't setting their kids up for success in the real world. They didn't understand the value of work, they didn't understand how to pay bills, they didn't understand how loans worked. And talking to any young adult, those lessons are some of the biggest shocks when you move out of home and I think you ask anyone and having those skills early and understanding how to use money to really support yourself in creating a life that is sustainable and that you really enjoyed, that's a wonderful skill. That's something so valuable to pass on to your kids and yeah, it's just sort of having again, self awareness around what am I role modelling to my kid? Is this going to help them in life? Is this something that is a sound behaviour to be passing on to them?

Phil: So what else do you like about.

Betsy: Well, you know, I always get sucked in by the bargains but I like looking at them, I never really buy them.

Phil: Yeah, I mean that centre table, I'm.

Betsy: Always curious, I'm like, what is in here today?

Phil: Ah, I know. I've got friends who have been Aldi fans for years and that's what they go know, like I bought a. Yeah.

Betsy: Which is fine if you were looking for a guitar. I think you got to tread carefully with those bargain tables. Is it actually something that you intended to spend or is it actually causing you to spend more? But yeah. My two favourite things at Aldi is the meat selection and the chocolate selection.

Phil: And they're not sponsors of this podcast.

Betsy: They are not sponsors of this.

Phil: I'm just a recent convert, uh, to Aldi. You know, their boccancini is great too.

Betsy: Oh yes.

Phil: And Halumi, great.

Betsy: Halumi too. Yes. We could go on, I feel, but yeah, Aldi's great.

Luke Cook has put together a course on financial well being for corporates

Phil: So tell us about the course. You've put together a course, haven't you? With a couple of other.

Betsy: Yeah. Yes. So Luke Cook from Cuppa TV, uh, which is a platform that provides well being content for know, we all spend a lot of time at work and research does show that when you do invest in your employees'well being, they enjoy their jobs, work better, they have better productivity and performance and they stay with you longer. So this is pretty good investment for corporates to do that kind of stuff.

Phil: Because it's a big thing for corporates these days to provide those sort of things and financial literacy and so many kinds of things that I don't know, I've always been a freelancer so I've never experienced any of this.

Betsy: That sounds amazing. Get me some of that. Yeah, so he runs Cuppa TV and that's what they sort of do. And they bring different experts from across Australia and the world to do that. And I'd been, uh, a long term speaker for, you know, Cookie himself has experienced different financial challenges. His first business was decimated by COVID and that came at a really challenging time in life with two little kids and a big mortgage and all of that. And he just really could see the value in actually equipping people with the tools to be able to navigate it. And then we pitched it to David and David Koch, and he was happily keen to be involved as well. Very passionate about personal finance. And again, just really tuned into the fact that this was going to be a tough time for a lot of people. And we all just shared the view that knowledge is power. Giving people the right tools and support to navigate this is going to result in better outcomes for individuals, better outcomes for communities and families, and what's not to love about that? So, yeah, we pulled it together. It's, uh, a ten part self study course, oodles of resources and activities to kind of download and do together. And that's where the real value lies, is applying not just watching the videos, but actually putting it into practise. And it's available to individuals, but it's also available to corporates. Uh, the AMP financial well being survey showed that it's about $2.6 billion every year that's lost in productivity because of the financial stress that individuals experiencing. And that's research from 2022. I'm curious to see what the data will be this year because it feels like this is the year that it really hit home for everyone.

Phil: And it's going to hit even harder next year because we've still got people going over the mortgage cliff. I think it's right peaking now, isn't it?

Betsy: It is now, that's right.

Phil: Late November, 2023.

Betsy: Yeah. And those jumps are huge. In some ways, this doesn't make logical sense, but I almost like that I was on a variable mortgage and had the incremental increase just because it wasn't such a shock. Because, again, lots of clients I'm working with are going from being at a 2% to a six 7% mortgage and it's many multiples of what they were paying previously. And that's hard to come up with that kind of money suddenly, as we all know, you've got to be making some priority calls and we just don't like it.

Phil: Understandably so people can experience the course. I mean, there's a free video that explains what's in the course as well. It's a great video. I've enjoyed watching it.

Betsy: Oh, thank you.

Phil: With you and Koshi and Cookie, all these Aussie nicknames, I've never been but once. The Aussie nicknames with Luke and David.

Betsy: David and Betsy and a Betsy. But yes. Well, yeah, you can access the first module completely free. There's also an introductory video. I think it's really well priced in that you can have six months access for less than $100. I think it makes a great gift for someone in.

Phil: GReat gift? Yeah.

Betsy: Um, because talk about Christmas and not wanting to buy something for someone that they're just going to throw away. Equipping someone with skills and tools that they can have for a lifetime and can meaningfully change the trajectory of their life. I don't think there's many better gifts personally. Probably a little bit biassed as a money nerd. And again, if you are in a HR team or if you're an executive at a different company, trying to think of ways to support your people and noticing the strain, the stress, the lack of engagement because of external stresses, then yeah, this is something that you might consider looking at for your employees as well.

For listeners of this podcast, we've got a special deal, 10% discount

Phil: So for listeners of this podcast, we've got a special deal, 10% off.

Betsy: We do.

Phil: So the discount code is pod offer for a 10% discount. So that's pretty good for a $99.

Betsy: Course, another $10 off, more money in.

Phil: Your pocket makes it pretty inexpensive.

Betsy: That's right. And Pod offer is P-O-D-O uh, F E, uh, R. Just because this is.

Phil: There'll be links in the blog post and the episode.

Betsy: Yeah. Yes, but yeah, that's available. And again, if you're someone that is experiencing this, if you've got family members experiencing this, help them to be an action hero. Uh, help them to resolve this problem, because it is figureoutable. There are so many things you can do about it, but it's that acknowledging the overwhelm, the paralysis, and giving them a path forward, I think is one of the best things you can do.

Phil: And going back to World War II, keep calm and carry on.

Betsy: Yeah, nice link there, Phil. I like that.

Phil: Betsy, thanks very much for coming back on. It's been great to see you.

Betsy: Thank you so much, Phil. And thanks for giving this topic some attention. It's certainly an issue right now, isn't it?

Phil: Yeah, although it's not about shares, but what the hell? What the.

Betsy: Hey, thanks for including us.

Chloe: Thanks for listening to shares for beginners you can find more@Sharesforbeigners.com if you enjoy listening, please take a moment to rate or review in your podcast player, or tell a friend who might want to learn more about investing for their future.

Any advice in this blog post is general financial advice only and does not take into account your objectives, financial situation or needs. Because of that, you should consider if the advice is appropriate to you and your needs before acting on the information. If you do choose to buy a financial product read the PDS and TMD and obtain appropriate financial advice tailored to your needs. Finpods Pty Ltd & Philip Muscatello are authorised representatives of MoneySherpa Pty Ltd which holds financial services licence 451289. Here's a link to our Financial Services Guide.